VASEP forecasts that seafood exports may grow by 10% over the same period and reach US$9.4 billion in 2021, in which, the growth driver will come from shrimp and pangasius.

According to the analysis team of SSI Securities, the seafood industry is highly sensitive to the pandemic because: disruptions to the global supply chain create both opportunities and challenges; and Average selling price decreased due to reduced demand, especially demand in the restaurant channel.

VASEP forecasts that seafood exports may grow by 10% over the same period and reach US$9.4 billion in 2021 (higher than the average growth rate (CAGR) in 2016-2019 period of 6.8%). , in which shrimp exports are still the growth engine (+15% y/y to US$4.4 billion), followed by pangasius (+5% y/y, reaching US$1.6 billion) and other companies. other aquatic products (+6% over the same period reached 3.4 billion USD).

However, SSI believes that such a strong shrimp export growth is not feasible, as the recovery of (India) supply after Covid-19 may restrain the growth of Vietnam's shrimp exports. Shrimp exporting companies will find it difficult to replicate the growth achieved in 2020 in the face of competition from India.

Also note that the shrimp farming cycle is short (only 3-4 months), and it is estimated that competition with India in the US and EU markets (which contributes 37% of the export value of Vietnamese shrimp) will become fierce. more in the second half of 2021.

However, exporters with Aquaculture Stewardship Council (ASC) certification may see more opportunities to expand in the EU market as the EVFTA comes into effect throughout the year. Average selling price may increase as demand gradually increases, helping to improve gross margin.

For pangasius, the analysis team estimates a recovery in both volume and average selling price will boost export value growth for the whole year, especially in the second half of 2021 when the vaccine is widely available. more widely in the US and EU, this could encourage seafood consumption in the restaurant channel.

The problems and risks in 2021 are likely to be the possibility that the US may impose tariffs on seafood products imported from Vietnam, after the USTR Section 301 investigation on monetary policy. The potential entry of Nam Viet Joint Stock Company (ANV: HSX) into the US market may cause competitive pressure in this key export market. In 11M2020, the US accounted for 33% of VHC's total revenue.

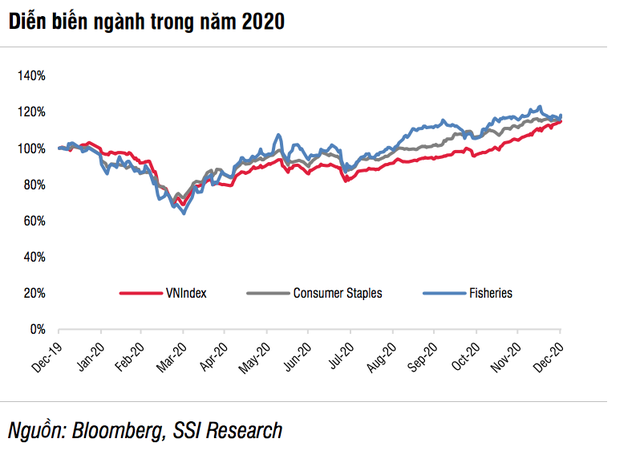

Looking back at 2020, the seafood industry has had a structural change after the Covid-19 epidemic. The global supply chain was disrupted for the whole year. World demand for seafood products has dropped significantly, causing prices to fall to new lows. Domestic raw material shrimp prices hit a bottom of VND82,500/kg in October (-12% y/y and -14% y/y) while domestic raw fish prices dropped to VND17,750/kg (- 14% YoY and -10% YoY). Notably, this drop occurred even above the previous year's low. Despite the reduced demand, shrimp exporters still find opportunities from the weakening of global supply and boost exports in terms of output. According to Rabobank, India's shrimp production is estimated to decrease by 10%-15% year-on-year in 2020, creating an opportunity for other countries to take advantage of the increased exports.

On the other hand, export demand for pangasius dropped sharply due to social distancing measures in the region implemented in all major pangasius export markets. This affects not only the export value to China, the leading pangasius import market, but also the US and EU markets (Vietnam's 2nd and 3rd largest markets).

The total export value of Vietnamese seafood companies in 11 months of 2020 reached 7.7 billion USD (-2% over the same period). By product type, shrimp export value reached 3.4 billion USD (+11% yoy) and pangasius export value reached 1.4 billion USD (-25% yoy). Although shrimp export value grew strongly, the low average selling price caused the gross profit margin of shrimp exporting companies to decrease.

Pangasius exporters also recorded a decline in gross margin through the third quarter. However, as shrimp and pangasius prices started to increase at the beginning of the fourth quarter, SSI expects a higher gross margin overall. exporting companies, starting from the fourth quarter of 2020. VASEP estimated that seafood export value at the end of the year was flat compared to the same period last year (reaching 8.6 billion USD), of which shrimp export value reached 3.8 billion USD (+12.4% compared to the same period last year). same period) and pangasius export value reached 1.5 billion USD (-24% over the same period).